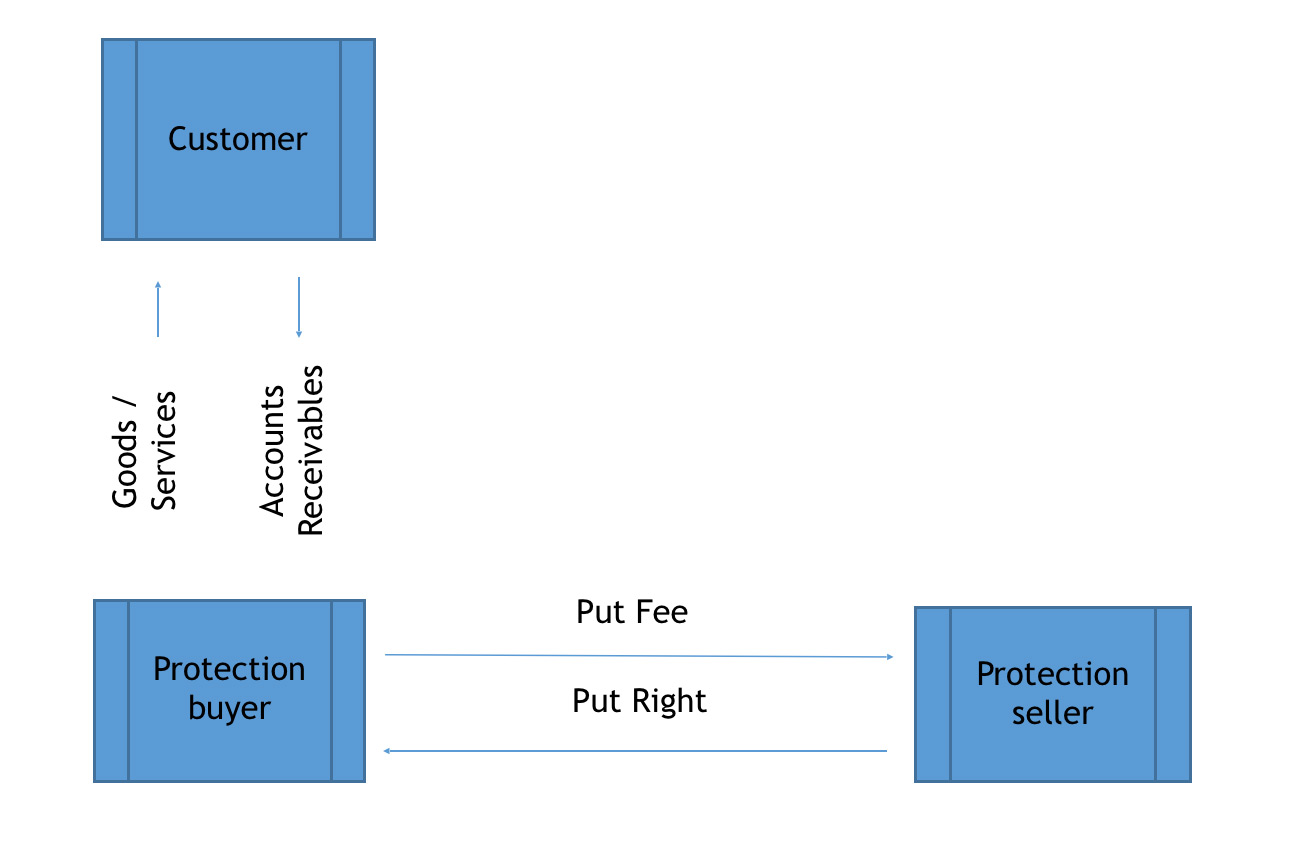

The Receivables Put Market has grown significantly in recent years. Receivables Puts compliments traditional credit insurance as a market based single risk solution for higher risk buyers. Available on buyers that trade in the US Capital Markets, coverage is non-cancelable, can be set at 100% indemnity, and pays out on bankruptcy or liquidation.

Put contracts range in size from $500k TO $1BLN+, tenor of the put is 3 months to 3 years.